20. How to specify tax rules with WHMCS

Certain countries and states require you to collect taxes on your sales. WHMCS allows you to specify the tax rates on a regional basis.

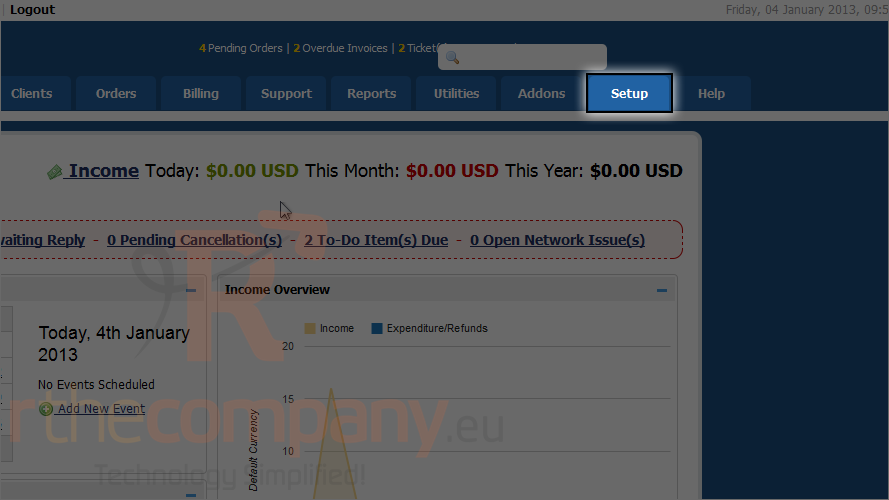

1) Go to setup.

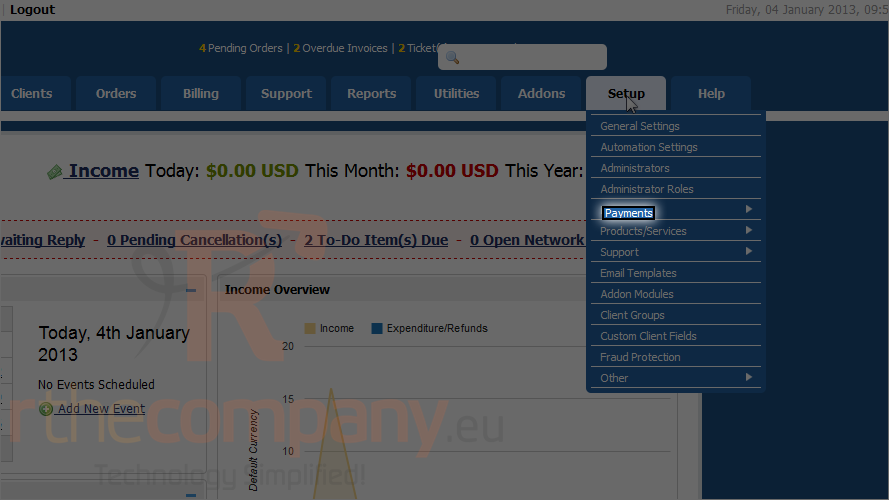

2) Mouse hover payments.

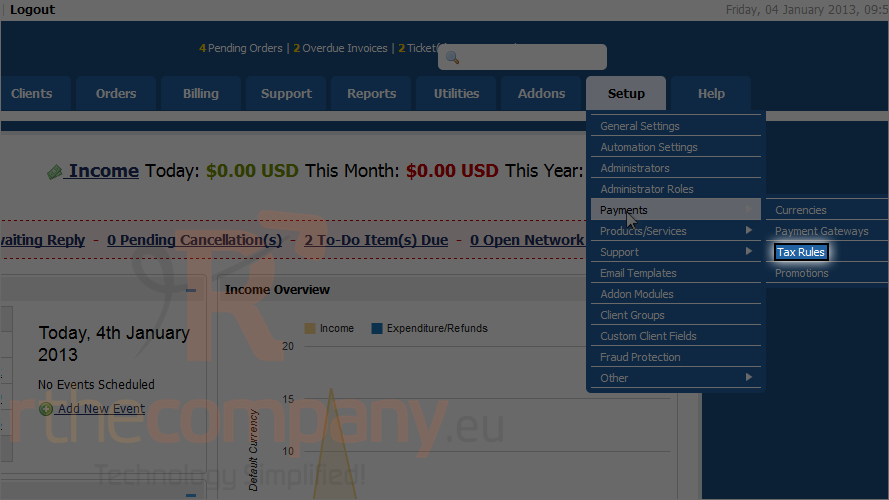

3) Click tax rules.

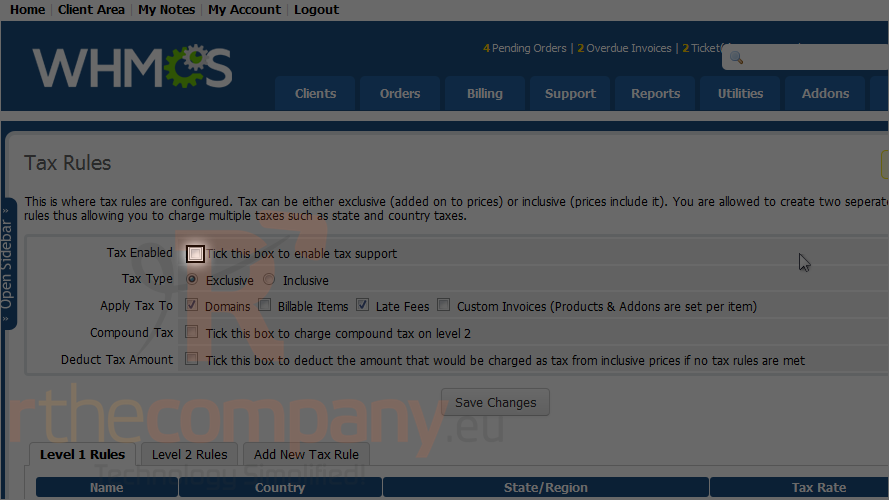

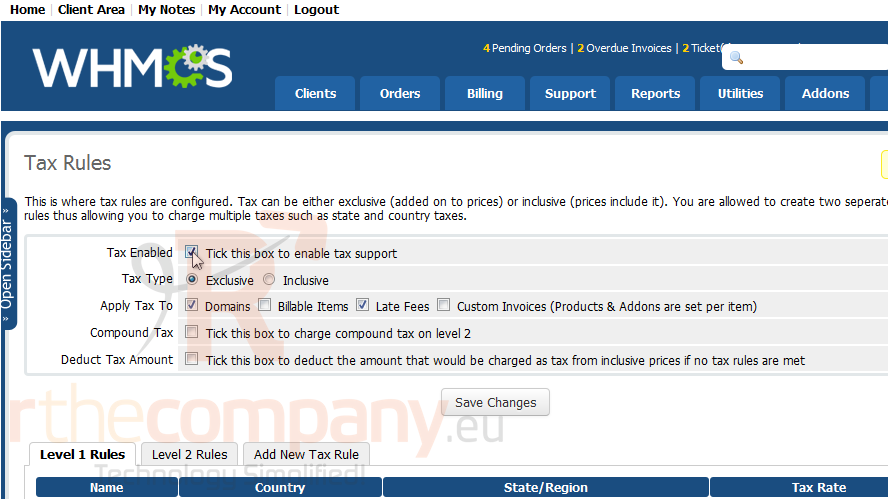

4) By default, taxes are not enabled. Check this box to enable them.

5) Select whether you want your prices to include the taxes (inclusive) or have them added on top of your prices (exclusive).

6) Using these fields, specify whether taxes should be applied to domains, custom invoices or late fees.

Enabling compound tax will apply the level 2 tax rates to the total after level 1 taxes have been applied instead of to the subtotal.

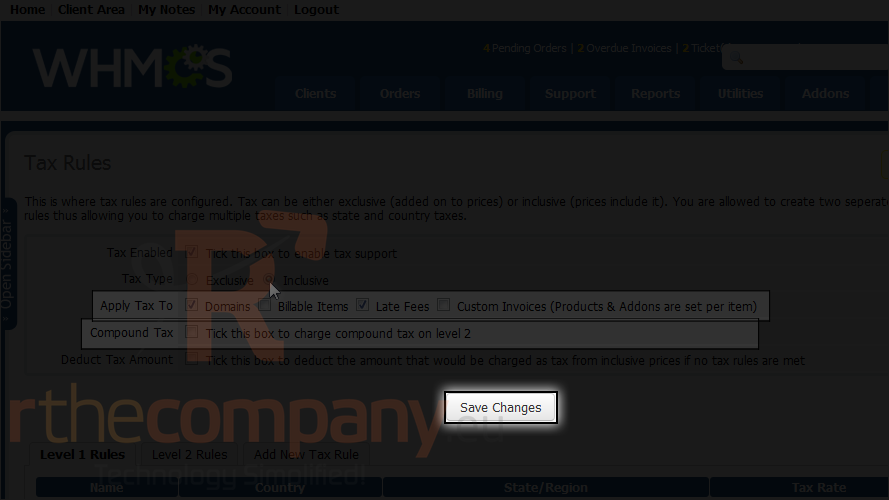

7) When finished, click save changes.

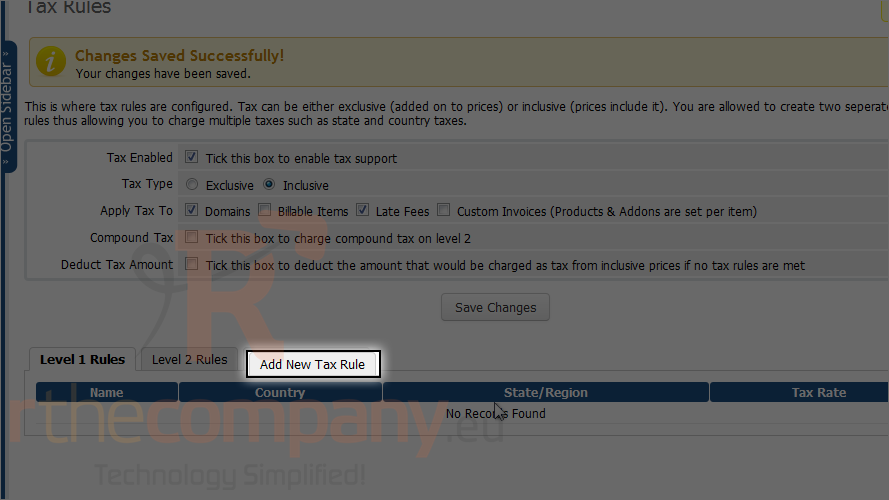

Now let's add a tax rule to level one. Scroll down.

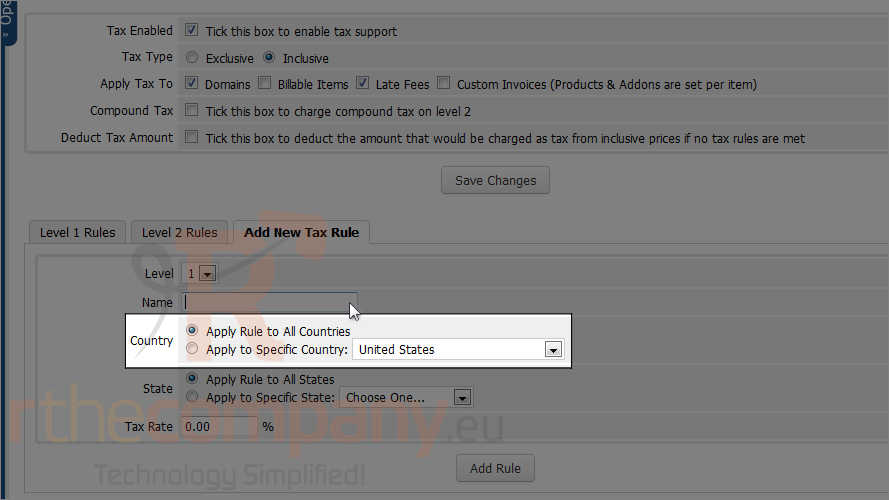

8) Click add new tax rule.

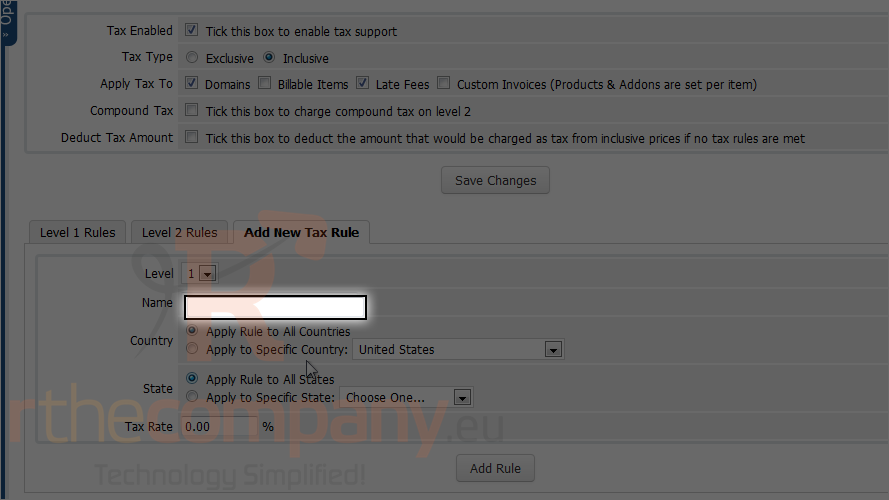

9) Give the tax a name.

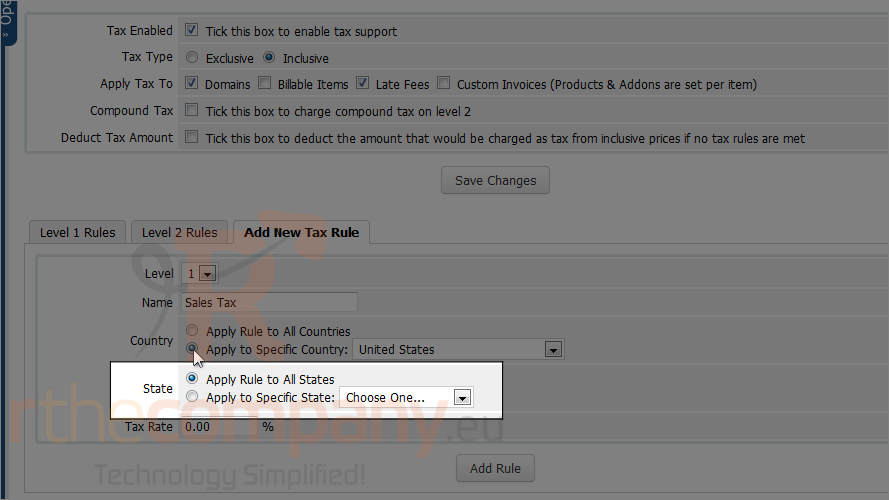

10) Choose whether the rule should apply to all countries or a specific country.

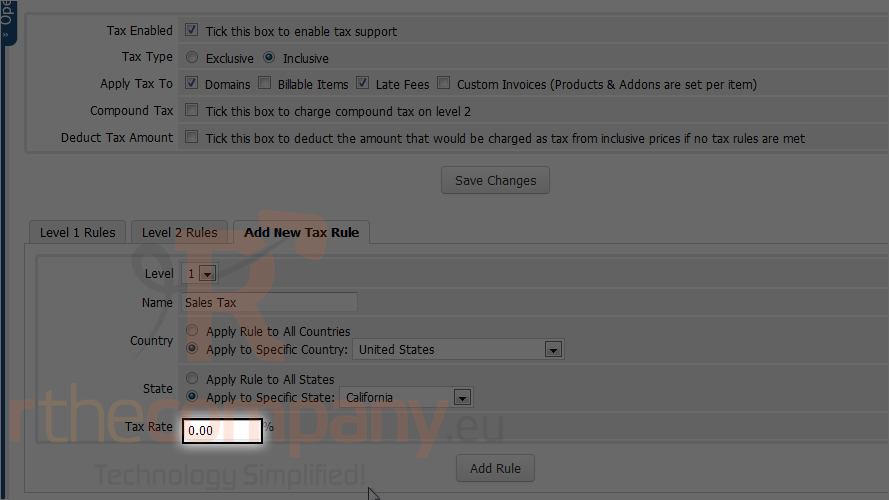

11) Do the same thing for state.

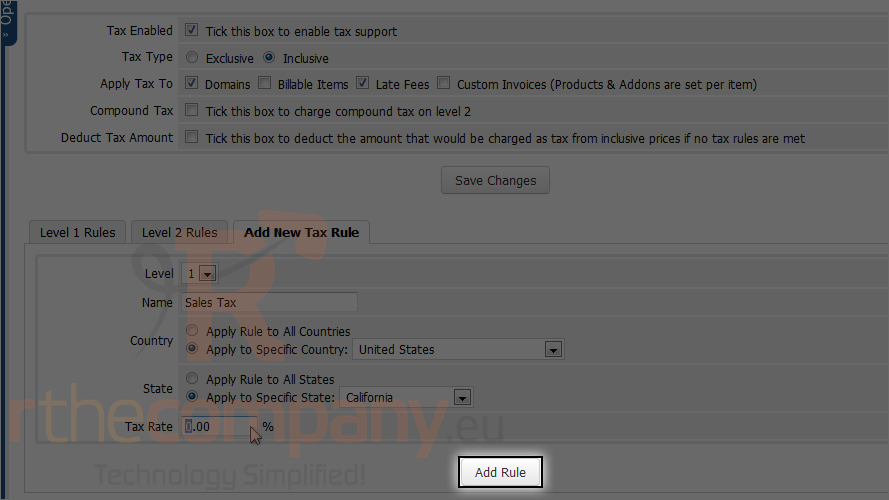

12) Last, set a tax rate.

13) To finish, click add rule.

You can add as many tax rules to either level as you want.

That's it! You now know how to specify tax rules with WHMCS.